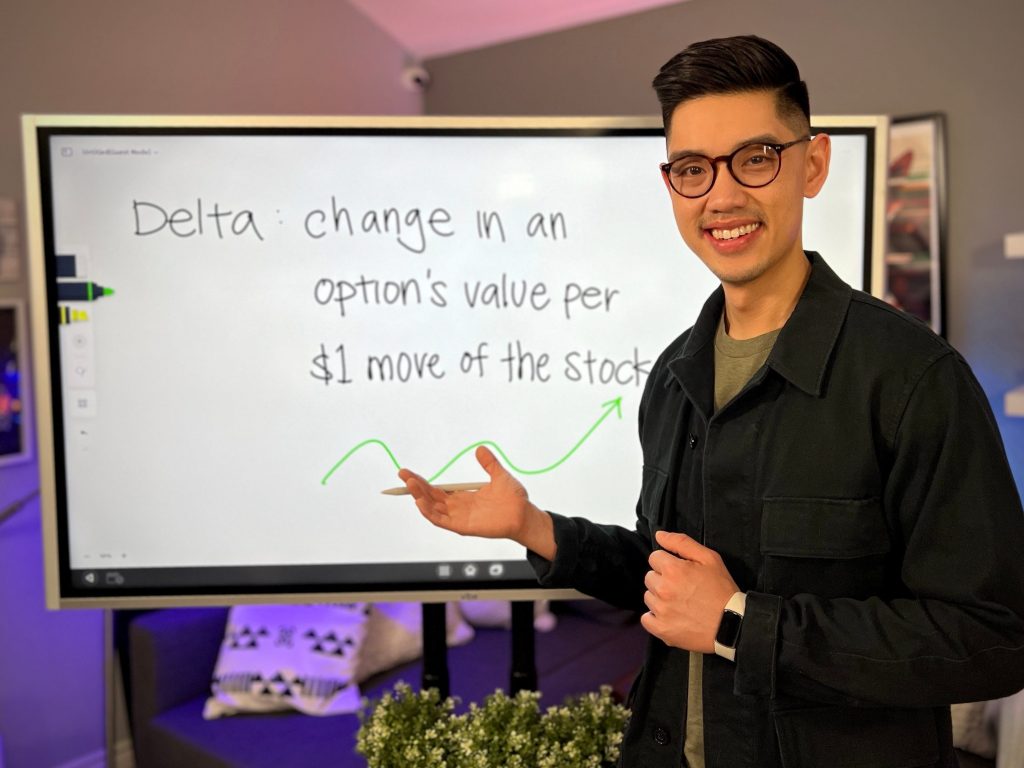

- Steve Chen focuses on the delta and theta decay when setting up bear calls spreads.

- He sticks to delta rates between 0.16 to 0.20 to collect premium and mitigate risk.

- He also keeps his contracts between four to six weeks for ideal theta decay.

Steve Chen was a middle-school math teacher before he became an options-trading wizard. His math and teaching skills now come in handy both when he’s determining optimal settings for his options contracts, and coaching others on how to do the same.

Today, he’s the founder of Call To Leap, a website that teaches financial education around saving and investing, including options trading, for a fee. He also shares daily finance tips and simplifies basic stock market terminology in short videos through his TikTok and Instagram.

This outcome wasn’t planned. When Chen started his teaching career, he didn’t anticipate ditching his job by the age of 33. But after realizing his $5,000 monthly paycheck and all the deductions it incurred wouldn’t be enough to live comfortably in a state like California, he began looking for additional income streams.